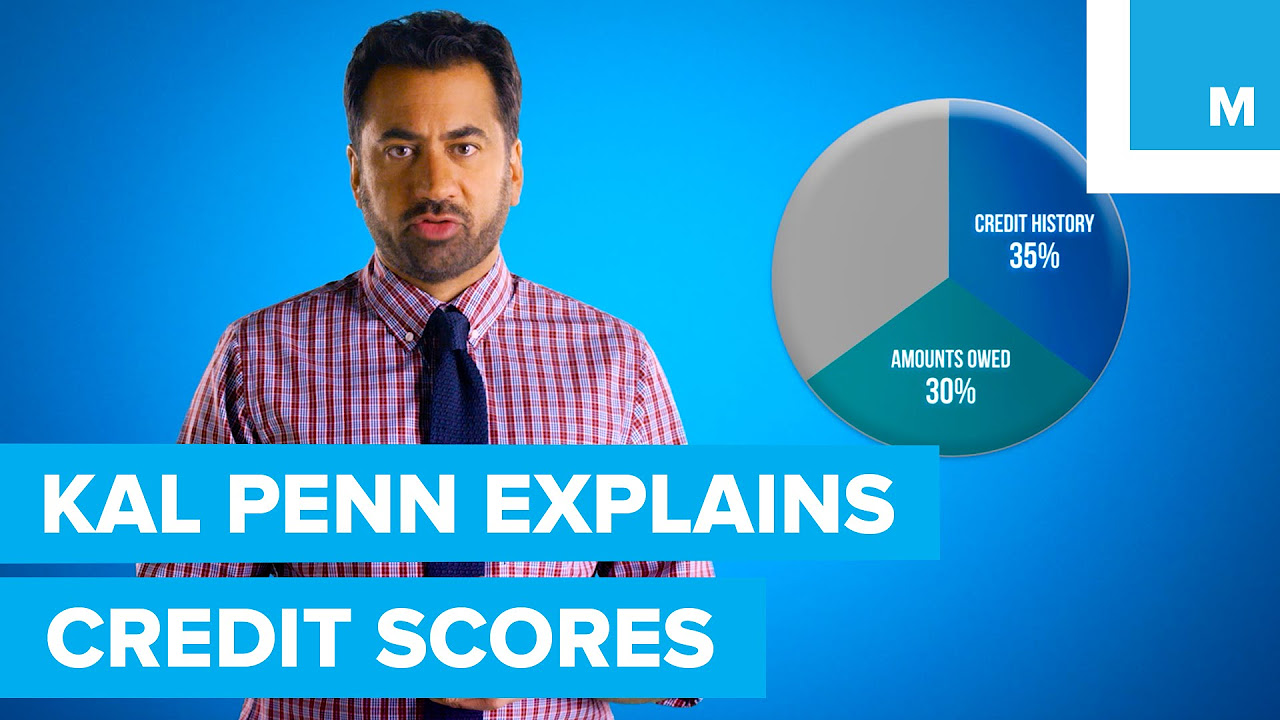

Among those questions you could be having is whether obtaining a loan may hurt your credit. At a glance, loans and how you handle them determine the score which you are going to ever have. Among the essential components in the calculation of your credit, loans can improve or decrease your own score. If you pay late, then they’d certainly hurt your credit if you don’t make subsequent payments on time. Your credit report is a snapshot that creditors use to determine whether or not you are creditworthy. This preliminary examination may be counterintuitive since you require a loan to build a fantastic history. In other words, if you didn’t have a loan in the past, your success rate may be very minimal. That said, the relationship between loans is a terminal string, and you are going to require a loan to demonstrate yourself. If you’ve had a good payment history in the past, the loan issuer may think about your program. In the event that you continuously make overdue payments, prospective lenders will question your loan eligibility. If you’ve damaged your report before, taking out a fresh loan could help you restore it. The debt quantity accounts for more than 30% of your credit report, and you should pay much attention to it.

Among those questions you could be having is whether obtaining a loan may hurt your credit. At a glance, loans and how you handle them determine the score which you are going to ever have. Among the essential components in the calculation of your credit, loans can improve or decrease your own score. If you pay late, then they’d certainly hurt your credit if you don’t make subsequent payments on time. Your credit report is a snapshot that creditors use to determine whether or not you are creditworthy. This preliminary examination may be counterintuitive since you require a loan to build a fantastic history. In other words, if you didn’t have a loan in the past, your success rate may be very minimal. That said, the relationship between loans is a terminal string, and you are going to require a loan to demonstrate yourself. If you’ve had a good payment history in the past, the loan issuer may think about your program. In the event that you continuously make overdue payments, prospective lenders will question your loan eligibility. If you’ve damaged your report before, taking out a fresh loan could help you restore it. The debt quantity accounts for more than 30% of your credit report, and you should pay much attention to it.

Based on the FCRA, you can dispute any unwanted element in your credit report. Essentially, if the reporting agency can not verify the item, it certainly must be removed. Since no thing is foolproof of making mistakes, credit information centers have some mistakes in consumer reports. For those who have any issues with regards to in which as well as how you can make use of Prahacom`s blog, you’ll be able to e-mail us from our own page. A close evaluation of American consumers reveals that about 20 percent of them have errors in their own reports. Your credit report is directly proportional to a score, which means that a lousy report could hurt you. Since your score informs the type of customer you’re, you need to place heavy emphasis on it. In many situations, a bad credit score could influence your ability to acquire decent quality loans. Having said that, you should operate to delete the harmful entries from your credit report. Late payments, bankruptcies, hard questions, compensated collections, and fraudulent activity can affect you. Since damaging elements on a credit report can affect you, you need to try and remove them. There are different ways of removing negative things, and among these is a credit repair company. Most customers demand a repair business whenever there are lots of legal hoops and technicalities to maneuver. To make certain you go through each of the steps easily, we’ve compiled everything you want to learn here.

The FCRA explicitly claims you could dispute any negative item on a credit report. In essence, the responsible information center has to delete the data if it can’t confirm it as valid. The 3 information centers — Experian, Equifax, and TransUnion — are more prone to making mistakes . In accordance with the FCRA, at least 20 percent of US citizens have confused in their credit reports. Your credit report is directly proportional to your score, meaning that a lousy report could hurt you. Moreover, your score determines your creditworthiness — to get any standard or lines of credit loan. Most loan issuers turn down applications since the consumers have a bad or no credit report. Ever since your loan negotiation ability will be crippled because of negative entries, you should delete them. From delinquencies to bankruptcies, paid collections, and queries, such components can affect you. Detrimental entries can tank your credit score; hence you need to attempt to remove all them. You’re able to remove the negative items by yourself or involve a credit repair firm. Several consumers choose to utilize a repair business when they realize they can’t undergo all hoops. In this piece, we’ve compiled a detailed series of steps on which you want to learn about credit restoration.

There are many credit repair companies within this landscape. Since there are plenty of generic testimonials, locating the ideal one may be an uphill job. If you’ve worked on your own credit report earlier, you undoubtedly know how credit repair can help. Within this age, you can search the world wide web to obtain the ideal repair choices you have. In a glance, you will notice that choosing from the hundreds of repair companies on the web can be difficult. Moreover, you would not want to invest funds on a company with no solid history. Having helped a lot of people resolve their credit difficulties, Lexington Law is an incredibly reputable firm. While remaining in the scene for extended doesn’t guarantee favorable results, this company has more than that. Legally, this company has turned out to maintain stringent Federal criteria in this a heavily-monitored scene. Besides, it has sustained a favorable track record over the years. As one of the high-rated credit repair businesses, Lexington Law is definitely worth your consideration.

Having bad credit is not the end of the road — you may make an application for a second chance checking accounts. If your application for a standard checking account is not fruitful, second chance checking would be ideal. During approval, the bank would refer to the ChexSystems database. Banks report poor credit behavior coupled with your financial records into the ChexSystems database. If your records are in this database, then it means your credit history isn’t comprehensive. Your probability of success are completely dependent on whether your records seem in ChexSystems. Some financial institutions offer their customers another chance to build a good credit report. Without a doubt, you wont locate the components of a typical checking account at another account. Obviously, second chance checking account have tremendous benefits and a few disadvantages too. Although you will certainly repair your own credit together, they generally have high fees. Additionally, you can not use the overdraft feature because they are intended to demonstrate your fiscal area. The bright side of the account is that it is better than guaranteed credit cards or check-cashing.

Having bad credit is not the end of the road — you may make an application for a second chance checking accounts. If your application for a standard checking account is not fruitful, second chance checking would be ideal. During approval, the bank would refer to the ChexSystems database. Banks report poor credit behavior coupled with your financial records into the ChexSystems database. If your records are in this database, then it means your credit history isn’t comprehensive. Your probability of success are completely dependent on whether your records seem in ChexSystems. Some financial institutions offer their customers another chance to build a good credit report. Without a doubt, you wont locate the components of a typical checking account at another account. Obviously, second chance checking account have tremendous benefits and a few disadvantages too. Although you will certainly repair your own credit together, they generally have high fees. Additionally, you can not use the overdraft feature because they are intended to demonstrate your fiscal area. The bright side of the account is that it is better than guaranteed credit cards or check-cashing.

Каталог АПК Сайт для профессионалов АПК

Каталог АПК Сайт для профессионалов АПК