Sky blue is a credit repair company that has been established in 1989 and based in Florida. Most consumers claim they begin seeing positive results after 30 days of use. Moreover, the business argues that clients use their services for six months to achieve full results. When utilizing skies blue, you can expect to reap the couple’s reduction, online credit ratings, and tracking. In the course of your subscription, you can pause the subscription by contacting customer support. In case you don’t reach your desired outcome, you can receive a complete refund within 90 days of your claim. Without a doubt, sky blue has its associated disadvantages — especially on the setup and credit report charges. You’ll pay a $39.95 recovery fee even before commencing the credit repair process. Besides, you’ll have to pay $69 to start the procedure though you won’t have a guarantee for results. In other words, you are able to pay for weeks without seeing a substantial increase in your score. Considering that going the process of credit repair isn’t cheap, you need to select your options carefully.

Sky blue is a credit repair company that has been established in 1989 and based in Florida. Most consumers claim they begin seeing positive results after 30 days of use. Moreover, the business argues that clients use their services for six months to achieve full results. When utilizing skies blue, you can expect to reap the couple’s reduction, online credit ratings, and tracking. In the course of your subscription, you can pause the subscription by contacting customer support. In case you don’t reach your desired outcome, you can receive a complete refund within 90 days of your claim. Without a doubt, sky blue has its associated disadvantages — especially on the setup and credit report charges. You’ll pay a $39.95 recovery fee even before commencing the credit repair process. Besides, you’ll have to pay $69 to start the procedure though you won’t have a guarantee for results. In other words, you are able to pay for weeks without seeing a substantial increase in your score. Considering that going the process of credit repair isn’t cheap, you need to select your options carefully.

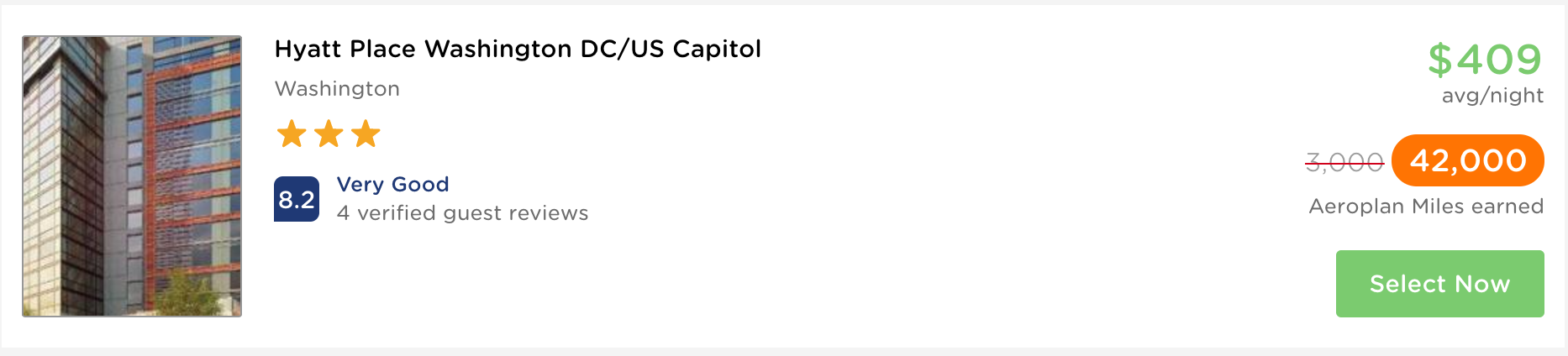

Certainly, using a credit card is remarkably prestigious across the united states. Countless consumer tales point towards going through enormous hurdles to obtaining one. While you’ll certainly enjoy the advantages of this card, the downsides are inevitable. First card issuers consider several elements of your credit report before approving your application. This variable means that your odds of acceptance when you have a bad score, are incredibly slim. After obtaining the card, you will need to look at your spending habits, payment history, and utilization. If you fail to maintain good financial habits, your credit rating will certainly drop. Additionally, Credit Score the program adds a tricky inquiry for your report, which also affects your score. Distributing several unsuccessful software would include many inquiries in your report. As soon as you receive the card, then adhering to the strict credit regulations would work to your leverage. Failure to obey the regulations will tank your credit rating and harm your report.

The FCRA explicitly states you could dispute any negative item on a credit report. Primarily, if the credit bureau can not confirm the info, it must delete it. Charge information facilities make a lot of mistakes — making such errors highly prevalent. The FCRA claims that close to one in every five Americans have errors in their accounts. Since your report goes together with your score, a lousy report could severely damage your score. Your score dictates your own creditworthiness in any credit card program of traditional loans. Most loan issuers turn down applications since the customers have a poor or no credit report. It is vital to work on removing the negative entries from the report maintaining this element in mind. There are plenty of negative things that, if you do not give adequate attention, could damage your document. Since damaging elements on a credit report can impact you, you need to make an effort to remove them. You’re able to eliminate the negative items by yourself or require a credit repair firm. As this procedure involves a lot of specialized and legalities, most people opt for using a repair company. Since credit fix can be an overwhelming process, we’ve compiled everything you want to learn here.

Having bad credit isn’t the end of the street — you may make an application for a second chance checking account. If your application for a standard checking account is not prosperous, second chance checking would be perfect. During approval, the bank would refer to the ChexSystems database. ChexSystems is an entity to which banks report bad credit behavior. If your documents seem in ChexSystems, your credit history could be faulty and not as creditworthy. Your probability of success are entirely determined by if your records seem in ChexSystems. In their attempts to help consumers repair bad reports, several financial institutions offer those accounts. However, there’s a disparity between these accounts along with a typical checking account. Obviously, second chance checking accounts have enormous advantages and a few downsides as well. While they offer you a chance to rebuild your broken credit, they generally have expensive fees. Worse still, you can not overdraw funds from the second chance checking accounts. Though it has some challenges, this checking account has an edge over secured credit cards.

In case you decide to involve a repair company, Credit Saint may be your perfect option. Should you beloved this article along with you wish to get more information regarding Http://Vinestreetmanorkc.Org kindly stop by the website. It is among the few institutions using an A+ BBB rating; hence it has plenty to offer. This company has been in business for approximately 15 decades and among the top-ranked within this particular landscape. The largest advantage of this company is the way that it educates consumers on different credit elements. To accommodate different customer needs, Credit Saint has three payment options. When preparing dispute letters, the paralegals customize the promises according to your precise needs. One noteworthy perk of this company is your 90-day money-back guarantee in case you’re not fully satisfied. Unsurprisingly, charge saint has some related drawbacks. Credit saint has significantly high setup fees and has limited accessibility. Across the usa, credit saint is offered in all states except South Carolina.

Каталог АПК Сайт для профессионалов АПК

Каталог АПК Сайт для профессионалов АПК