According to the FCRA, you can dispute any unwanted element on your credit report. Primarily, if the credit bureau can not confirm the information, it has to delete it. The three information centers — Experian, Equifax, and TransUnion — are more prone to making mistakes . A close evaluation of American consumers shows that about 20% of them have errors in their reports. Since your score depends on your own report, a bad report may damage your score severely. Because your score tells the type of customer you’re, you should put heavy emphasis on it. Several loan applicants have experienced an unsuccessful program due to a low credit score. Having said that, you should work to delete the harmful entries from your credit report. From delinquencies to bankruptcies, compensated collections, and queries, such components can impact you. Detrimental entries can tank your credit rating; hence you need to try and eliminate all them. Among the methods that operate with maximum efficacy is having a credit repair company to delete the items. Several consumers opt to utilize a repair business when they recognize they can’t undergo all hoops. Because credit repair can be an overwhelming process, we have compiled everything you need to know here.

Using Credit Saint to cure broken credit might be an perfect alternative for you. It is among the few institutions with an A+ BBB score; hence it has lots to offer. This firm has been in business for about 15 decades and among the top-ranked within this landscape. The largest advantage of this company is the way that it instructs consumers on different credit elements. Moreover, Credit Saint accommodates different consumer needs with its own three payment packages. Your assigned lawyer would prepare customized letters to customize your specific requirements. It’s great knowing they have a 90-day money-back guarantee if you are not entirely pleased. Besides all of the perks of the business, credit saint has some disadvantages. Credit saint has significantly high installation fees and has limited availability. If you are residing in South Carolina, then you might have to seek the services of other service providers.

Round the US, with a credit card continues being among the most efficient fiscal instruments. Countless consumer tales point towards going through huge hurdles to acquiring one. Of course, a charge card has its related perks and a few disadvantages as well. First off, credit card issuers look over your score prior to issuing you credit card. In other words, obtaining a very low credit score would almost guarantee a flopped program. You will need to consider your spending habits, utilization, and obligations after getting the card. Should you exceed the 30% use threshold or default in your payments, your credit rating will fall. Besides, sending your application authorizes the issuer to perform a tough question which affects your score. Sending out several unsuccessful applications would add many inquiries in your report. In regards to using the card, several exemptions adhere to high frequency standards. Failure to comply with the regulations would tank your credit score and damage your report.

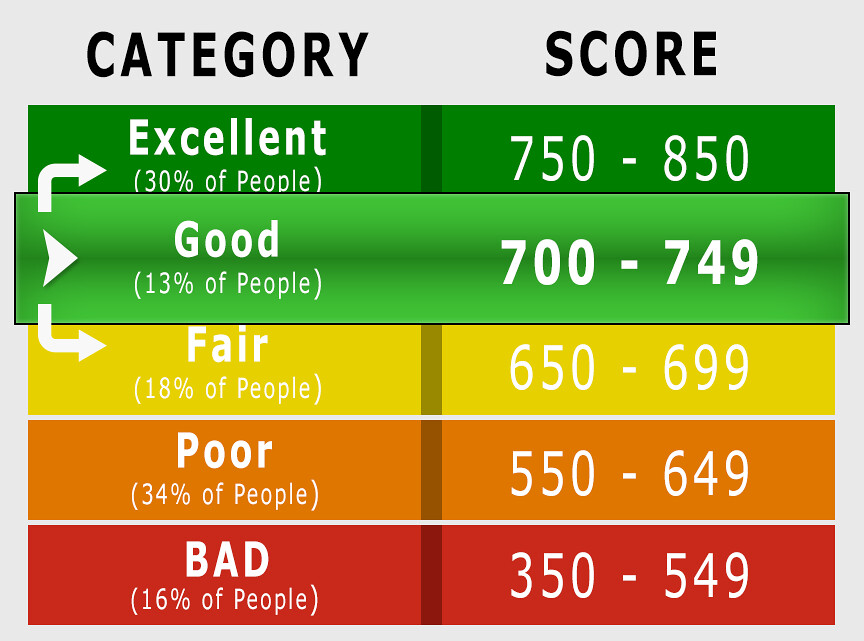

Prospective lenders don’t check your entire credit report; they utilize your score to judge you. Different lending businesses utilize customized approaches to take a look at their consumers’ reports. The very same differences in charge calculation versions also apply to credit card companies. Once you have poor credit, lenders will not contemplate your loan applications. In rare circumstances, your application may be successful, but you are going to pay high-interest prices and fees. For this reason, keeping your eye on your finances will help you stay on top of your financing. You can track your score to give you a comprehensive summary of your credit score. Considering that the three information centers give consumers a free credit report each year, you should optimize it. Retrieve your account and inspect the elements that could damage your credit report. Before focusing on complex items, start with working on straightforward elements. There are many repair companies; hence you ought to choose your desired one sensibly. Checking your report often and maintaining sound fiscal habits will function to your leverage.

Prospective lenders don’t check your entire credit report; they utilize your score to judge you. Different lending businesses utilize customized approaches to take a look at their consumers’ reports. The very same differences in charge calculation versions also apply to credit card companies. Once you have poor credit, lenders will not contemplate your loan applications. In rare circumstances, your application may be successful, but you are going to pay high-interest prices and fees. For this reason, keeping your eye on your finances will help you stay on top of your financing. You can track your score to give you a comprehensive summary of your credit score. Considering that the three information centers give consumers a free credit report each year, you should optimize it. Retrieve your account and inspect the elements that could damage your credit report. Before focusing on complex items, start with working on straightforward elements. There are many repair companies; hence you ought to choose your desired one sensibly. Checking your report often and maintaining sound fiscal habits will function to your leverage.

One perplexing thing which most individuals wonder is whether taking a loan out may hurt their credit. In brief, loans and the way you manage them is a vital factor in determining your credit. Different companies use various credit calculation versions, and they’re able to increase or reduce your credit rating. Having several delinquencies would always plummet your credit score. Primarily, loan issuers examine your credit report to determine the type of lender you’re. This truth may be counterintuitive since you need a loan to construct a positive payment history and report. In other words, when you have not had a loan before, your success rate could be incredibly minimal. Therefore, you’re going to want a loan to qualify to get another loan. Comprehensive payment history previously is a critical success factor when applying for a new loan. If you always make overdue payments, prospective lenders would question your loan eligibility. Applying to get a new loan may allow you to resolve a severely broken credit. Considering that the quantity of debt takes a massive chunk of your report (30 percent ), you ought to pay utmost attention to it.

Каталог АПК Сайт для профессионалов АПК

Каталог АПК Сайт для профессионалов АПК