Located in Florida, Sky blue charge is a credit repair company that was established in 1989. The company claims that most consumers see tangible results after the first 30 days of use. Additionally, the company asserts that customers use their services for just six months to achieve full outcomes. When utilizing sky blue, you can expect to benefit the couple’s reduction, online credit checks, and tracking. In the course of your subscription, you can pause the subscription by contacting customer service. If you are not able to achieve the desired effects, you can receive a refund as long as you claim within 90 days. Like any other company, skies blue has its associated disadvantages, such as the setup and credit report fees. The first measure is paying a retrieval fee of $39.95 until they start repairing your credit score. Additionally, you’ll require a setup fee of $69 to start the process, and you will not be guaranteed results. The sad part is you may pay for months without seeing substantial progress on your report. Credit repair is a enormous investment; therefore you should make your decisions carefully.

According to the FCRA, it is possible to dispute any negative element in your credit report. The credit reporting bureau is obligated to delete a disputed item that is shown to be illegitimate. Since no entity is foolproof of making errors, credit data centers have some errors in customer reports. The FCRA reports that roughly 1 in every 5 Americans (20 percent ) have errors in their credit reports. Your credit report is directly proportional to a own score, which means that a lousy report could hurt you. Your score dictates your creditworthiness in any credit card application of conventional loans. Many loan applicants have experienced an unsuccessful application because of a low credit score. Having said that, you should operate to delete the detrimental entries in the credit report. Late payments, bankruptcies, challenging questions, paid collections, and fraudulent activity can affect you. Since negative things can impact you severely, you should work on removing them from the report. You’re able to eliminate the negative items by yourself or involve a credit repair firm. Most men and women use credit repair businesses when they have to go through plenty of legal technicalities. Since credit fix can be a daunting process, we’ve compiled everything you want to know here.

According to the FCRA, it is possible to dispute any negative element in your credit report. The credit reporting bureau is obligated to delete a disputed item that is shown to be illegitimate. Since no entity is foolproof of making errors, credit data centers have some errors in customer reports. The FCRA reports that roughly 1 in every 5 Americans (20 percent ) have errors in their credit reports. Your credit report is directly proportional to a own score, which means that a lousy report could hurt you. Your score dictates your creditworthiness in any credit card application of conventional loans. Many loan applicants have experienced an unsuccessful application because of a low credit score. Having said that, you should operate to delete the detrimental entries in the credit report. Late payments, bankruptcies, challenging questions, paid collections, and fraudulent activity can affect you. Since negative things can impact you severely, you should work on removing them from the report. You’re able to eliminate the negative items by yourself or involve a credit repair firm. Most men and women use credit repair businesses when they have to go through plenty of legal technicalities. Since credit fix can be a daunting process, we’ve compiled everything you want to know here.

When you hunt’credit repair firm’ on google, you’ll see countless results popping up. Thinking about the vast number of reviews on the internet, finding the perfect one can be hard. If you have worked on your own credit report before, you definitely understand how credit repair can help. Since plenty of advice is published online, it is possible to search the internet to find the one which suits you. Considering that the internet is full of several repair businesses, locating the perfect one can be a daunting job. Moreover, you would not want to invest funds on a business without a solid history. Having helped many people solve their credit issues, Lexington Law is an incredibly reputable firm. While being in business doesn’t mean a company is great enough, Lexington has more than that to offer. In case you liked this short article as well as you want to be given details concerning Www.Storeboard.Com i implore you to pay a visit to our own web-page. At a highly-monitored landscape, Lexington Law has proven its effectiveness a hundred times over. Additionally, Lexington law continuously maintains an impeccable success speed during recent years. Lexington Law has an incredibly excellent track record and is certainly worth your consideration.

Most people always wonder if taking out a new loan could hurt their credit. In a nutshell, loans and the way you manage them is a vital factor in determining your credit. Since credit calculation models are usually complex, loans can either tank or boost your credit score. Should you pay late, then they would certainly damage your credit if you don’t make subsequent payments on time. Mostly, loan issuers analyze your credit report to ascertain the type of lender you are. This truth could be counterintuitive as you will need a loan to build a positive payment history and report. In other words, if you have not had a loan before, your success rate would be incredibly minimal. To qualify for a new loan, you are going to need a fantastic history and use ration to be eligible for credit. If you have cleared your invoices early before, they may consider you a creditworthy consumer. However, if your report is filled with delinquencies, potential lenders may question your eligibility. Taking out new loans might provide you the chance to build your credit if you’d damaged it. Considering that the amount of debt carries a huge chunk of your report (30%), you should pay utmost attention to it.

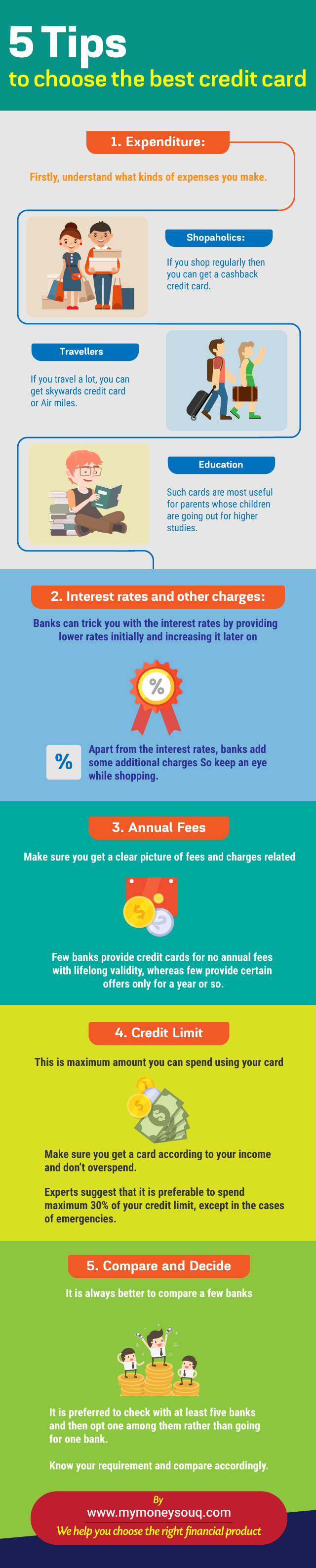

Round the US, using a credit card proceeds being among the most efficient fiscal tools. Countless consumer stories point towards moving through huge hurdles to obtaining one. Of course, a credit card has its associated advantages plus a few disadvantages as well. Before issuing you a card, charge card companies consider several metrics before approving it. If you’ve got a poor credit rating and background, your chances of getting a card would be meager. Besides, you’ll need to watch a couple of items once you acquire your card. Should you exceed the 30% use threshold or default in your payments, your credit rating will drop. Moreover, the application adds a hard inquiry to your report, which surely tanks your own score. The more you have failed applications, the more questions you are going to have in your report. In regards to using the card, many exemptions adhere to high frequency standards. In case you don’t stick to the stringent regulations, then you’ll undoubtedly get affected by the consequences.

Каталог АПК Сайт для профессионалов АПК

Каталог АПК Сайт для профессионалов АПК