According to the FCRA, it is possible to dispute any negative element on your credit report. Primarily, if the credit bureau can not confirm the info, it has to delete it. Since no entity is foolproof of creating errors, credit data centers have some mistakes in consumer reports. The FCRA reports that roughly 1 in every 5 Americans (20 percent ) have errors in their credit reports. Because your score depends on your own report, a lousy report may damage your score seriously. Besides, your score determines your creditworthiness — to get any standard or lines of credit loan. Oftentimes, a bad score may impair your ability to get positive rates of interest and quality loans. Having said that, it’s imperative to work on eliminating negative entries from your credit report. There are plenty of negative items that, if you do not give adequate attention, could hurt your document. Detrimental entrances can tank your credit rating; hence you should try and remove all of them. You can remove the negative items by yourself or involve a credit repair firm. Many consumers opt to use a repair company when they realize they can’t go through all hoops. To make certain you go through each of the steps with ease, we’ve compiled everything you need to know here.

Across the united states, with a credit card proceeds being among the most efficient fiscal instruments. Many people narrate how difficult it is to get a credit card without issues successfully. Like every other product, a credit card has a wide assortment of benefits and associated advantages. Before issuing you a card, credit card businesses consider several metrics prior to approving it. When you’ve got a bad credit rating and history, your chances of getting a card would be meager. Besides, you are going to need to see a couple of things once you get your card. If you neglect to maintain good financial habits, your credit rating would certainly fall. Additionally, the application adds a hard inquiry to your account, which also impacts your score. The more you’ve failed applications, the more questions you are going to have on your report. When it comes to utilizing the card, many issuers adhere to high regularity standards. If you fail to stick to the regulations, then you’ll experience long-term consequences on your report.

Utilizing Credit Saint to heal broken credit might be an perfect alternative for you. It’s among the few associations using an A+ BBB rating; hence it has lots to give. This company has been operating for approximately 15 decades and among the top-ranked within this particular landscape. One noteworthy element is how the company continuously educates is customers on various credit problems. Besides, Credit Saint accommodates different consumer needs with its three payment bundles. Your assigned lawyer would prepare customized letters to customize your particular needs. If you are not fully satisfied, you’ll be able to be given a refund within 90 days of application. Despite the mammoth of benefits, credit saint has several related downsides also. The company isn’t available in all the states and has incredibly high setup fees. That said, you may need to use other support providers if you live in South Carolina.

Utilizing Credit Saint to heal broken credit might be an perfect alternative for you. It’s among the few associations using an A+ BBB rating; hence it has lots to give. This company has been operating for approximately 15 decades and among the top-ranked within this particular landscape. One noteworthy element is how the company continuously educates is customers on various credit problems. Besides, Credit Saint accommodates different consumer needs with its three payment bundles. Your assigned lawyer would prepare customized letters to customize your particular needs. If you are not fully satisfied, you’ll be able to be given a refund within 90 days of application. Despite the mammoth of benefits, credit saint has several related downsides also. The company isn’t available in all the states and has incredibly high setup fees. That said, you may need to use other support providers if you live in South Carolina.

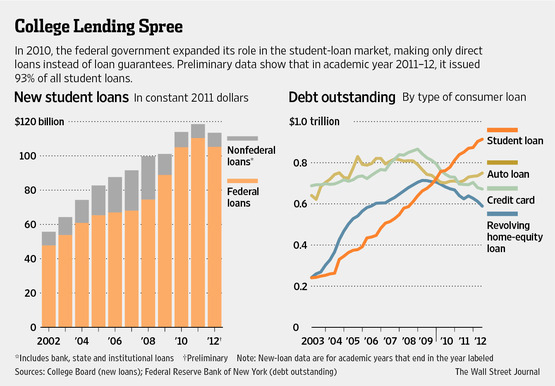

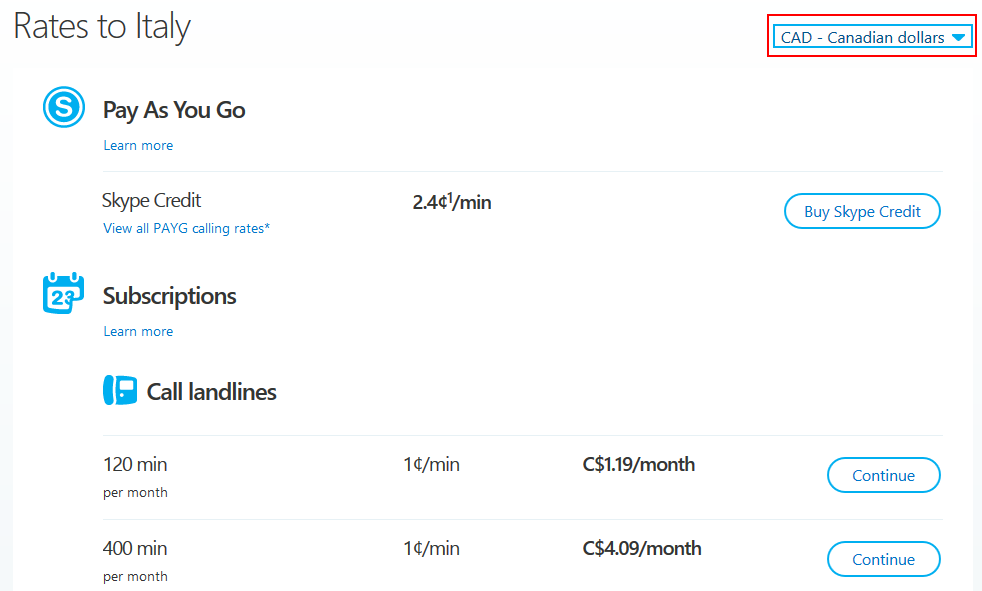

Since there are plenty of things that could damage your credit, you could be thinking about if it’s the loan does. In case you loved this informative article and you wish to receive more information relating to Credit Rates please visit our web page. Mostly, the way that you manage loans is a vital part in determining your credit. Since credit calculation models are generally complex, loans can either tank or boost your credit score. Unless you make timely payments, taking out a loan would be as good as tanking your credit rating. Primarily, loan issuers examine your credit report to determine the type of lender you are. This preliminary evaluation might be counterintuitive as you require a loan to construct a good history. Quite simply, if you did not have a loan previously, your success rate might be rather minimal. That said, you are going to need a loan and a good credit utilization ratio to meet the requirements for one. If you’ve had a fantastic payment history in the past, the loan issuer might think about your application. On the contrary, your program would flop if you’ve got a history of defaulting. If you’ve damaged your report before, taking out a fresh loan could help you reestablish it. Since the amount of debt carries a massive chunk of your report (30%), you should pay utmost attention to it.

Based on the FCRA, you can dispute any unwanted element in your credit report. Essentially, if the reporting agency can’t verify the product, it certainly has to be removed. Charge information centers make a lot of mistakes — which makes such mistakes highly prevalent. The FCRA asserts that near one in every five Americans have mistakes in their accounts. Since your score is dependent on your report, a lousy report could damage your score seriously. Since your score informs the type of customer you are, you should put heavy emphasis on it. Most loan issuers turn down applications since the consumers have a bad or no credit score report. It’s vital to work on removing the negative entries from the report keeping this element in mind. There are plenty of negative things which, if you do not give sufficient attention, could damage your report. Since damaging things can impact you badly, you should work on eliminating them from the report. One of the ways that work with maximum efficiency is having a credit repair company to delete the products. As this procedure involves a lot of technical and legalities, the majority of men and women opt for using a repair firm. Because credit repair can be an overwhelming process, we’ve compiled everything you need to know here.

Based on the FCRA, you can dispute any unwanted element in your credit report. Essentially, if the reporting agency can’t verify the product, it certainly has to be removed. Charge information centers make a lot of mistakes — which makes such mistakes highly prevalent. The FCRA asserts that near one in every five Americans have mistakes in their accounts. Since your score is dependent on your report, a lousy report could damage your score seriously. Since your score informs the type of customer you are, you should put heavy emphasis on it. Most loan issuers turn down applications since the consumers have a bad or no credit score report. It’s vital to work on removing the negative entries from the report keeping this element in mind. There are plenty of negative things which, if you do not give sufficient attention, could damage your report. Since damaging things can impact you badly, you should work on eliminating them from the report. One of the ways that work with maximum efficiency is having a credit repair company to delete the products. As this procedure involves a lot of technical and legalities, the majority of men and women opt for using a repair firm. Because credit repair can be an overwhelming process, we’ve compiled everything you need to know here.

Каталог АПК Сайт для профессионалов АПК

Каталог АПК Сайт для профессионалов АПК